FinTech continues to drive Innovation in 2021

Reech Corporations Group is on a mission to create long-term value for our investors, by finding ways to use technology and science to drive change. Our ethos is built around the entire financial ecosystem, this means that we are acutely aware of the impact of digital on growth and innovation. While the past years have been centred around customer interaction and engagement, we foresee continuous breakthroughs that will enable financial services to fully transition to digital which will generate higher long-term value. Highly confident of the future of financial technologies (FinTechs), we have gathered five key graphs to showcase the attractiveness of the industry.

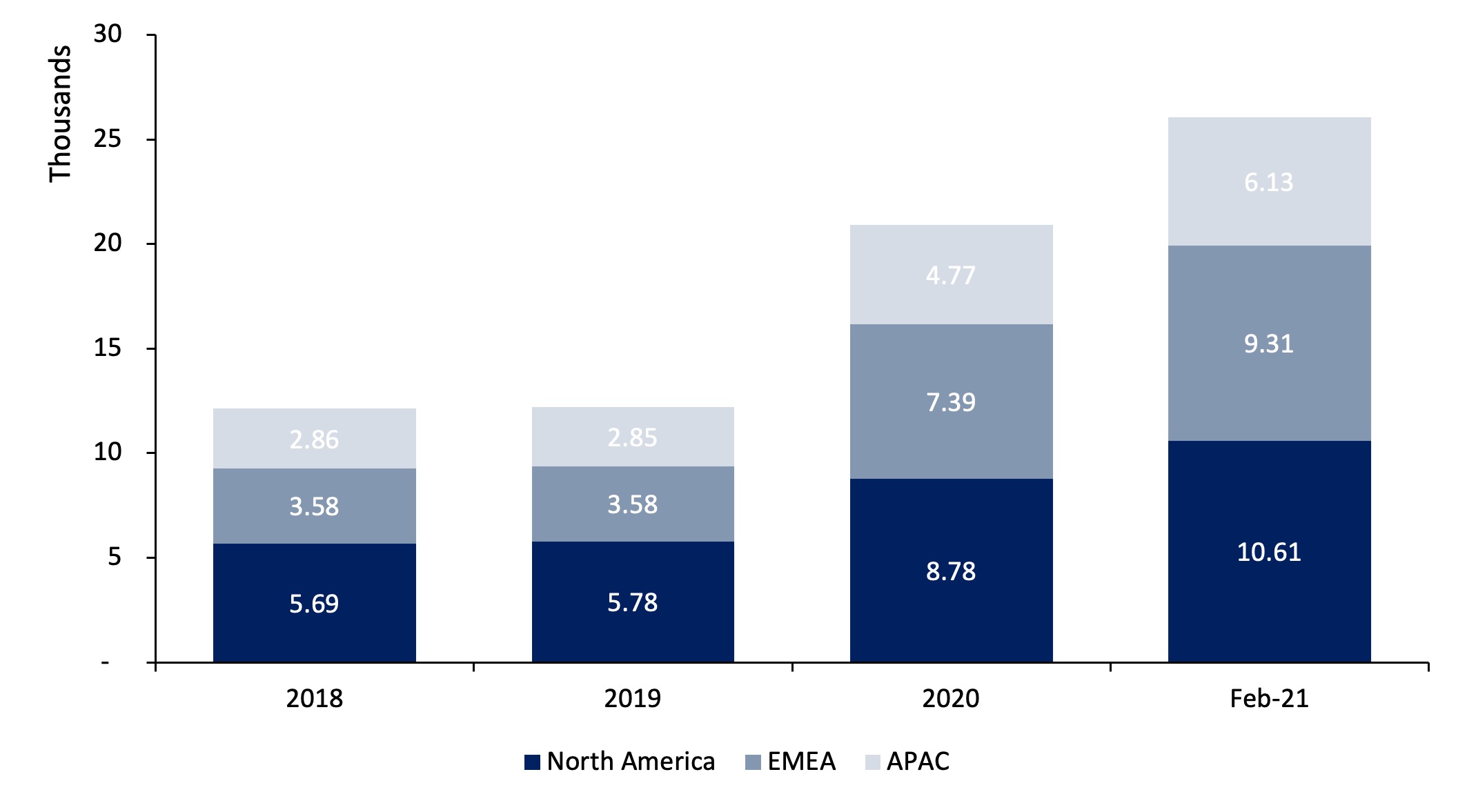

Number of FinTech Start-ups Worldwide from 2018 to February 2021, by Region

Source: Statista

The EMEA region is closing the gap with North America; the current leading FinTech hub

As of February 2021, North America remains the global FinTech leader with 10,605 companies. The EMEA region has been closing the gap over the past three years due to investors attractiveness in European assets after the surge of European unicorns over the past decade. This includes the likes of Klarna, Revolut, N26, Tink, Checkout.com and many more. We are confident that the EMEA market will remain a source of innovative breakthroughs in the coming years and overtake the US as the leading place for building a FinTech!

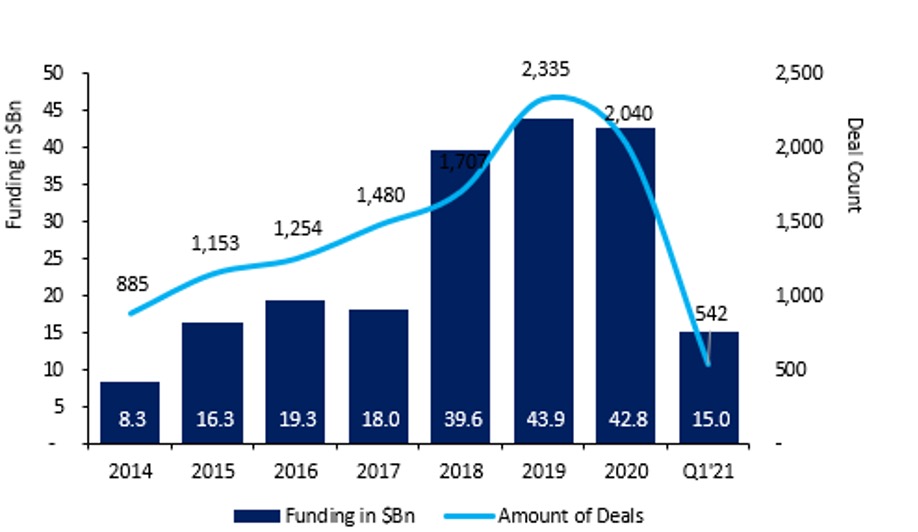

Global FinTech Investments from 2014 to February 2021

Source: CB Insights

Investors still see FinTech as an attractive asset class

By the end of the quarter, the level of funding into FinTechs will reach its highest level since Q2’2018 – when Ant Group raised $14Bn. As the industry matures in tandem with a clientele that acknowledges the benefits of such technologies, we foresee a continuous increase of the investment activity in the sector whilst the deal count will shift downward for bigger deal values.

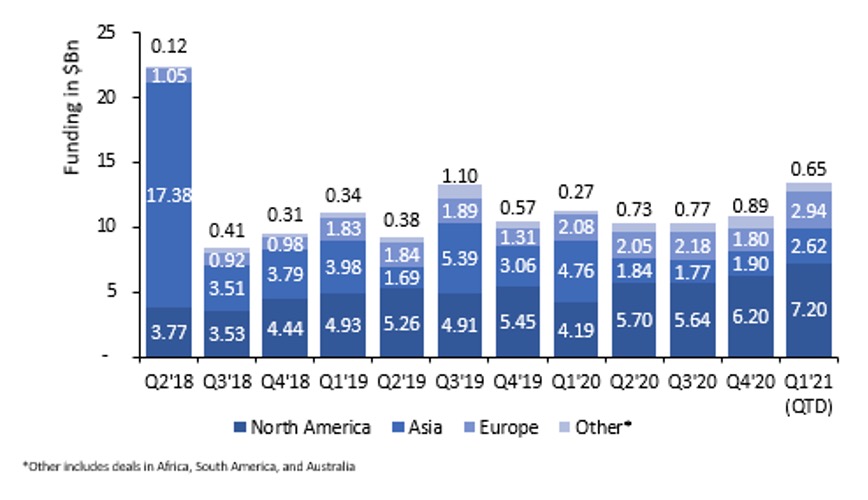

Funding of FinTech by Region Q2’2018 to February 2021

Source: CB Insights

North America remains the leader in funding FinTechs

While the gap in number of FinTechs between North America and the EMEA region is closing, the funding amount between the two regions remain significant; $7.2Bn versus $2.94Bn. Regulated with tighter restrictions than its North American counterpart, the EMEA region will face further rules in its key uptrend sectors such as “buy-now-pay-later” which include Klarna, and banking licences. We believe that this regulatory framework will create more robust European FinTech players, rather than slow down innovation in the financial services sector.

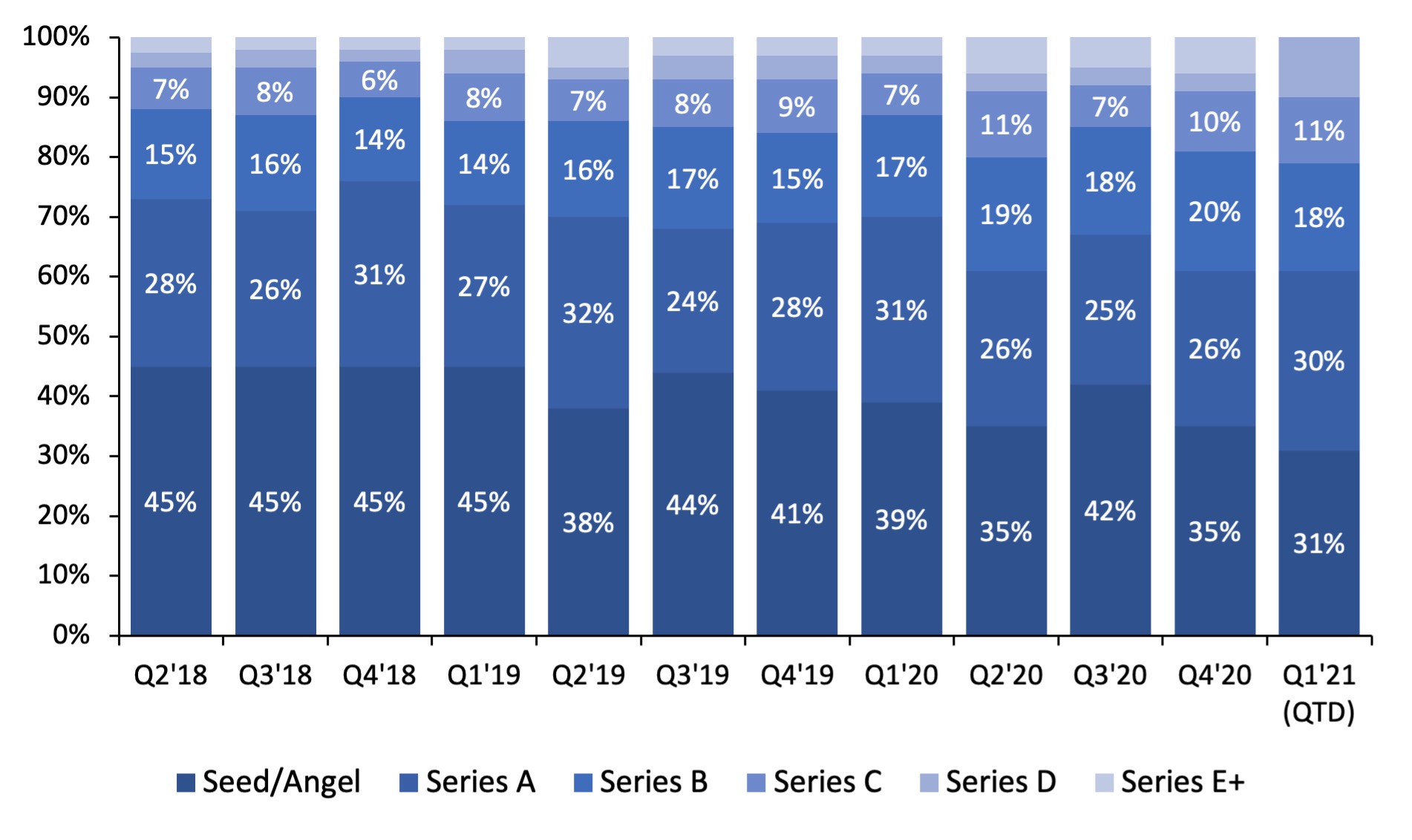

Percentage share of global FinTech Deals by stage, Q2’2018 to February 2021

Source: CB Insights

The industry is becoming mature and is shifting towards growth deals (Series B+)

While 2018 and 2019 were mostly composed of Seed/Angel and Series A deals, the industry will shift towards Series B+ deals. To sustain the growth of mature FinTechs, European asset allocators will have to deploy the right funding into European investors, to avoid having FinTech emerging leaders raise capital outside of the EMEA region.

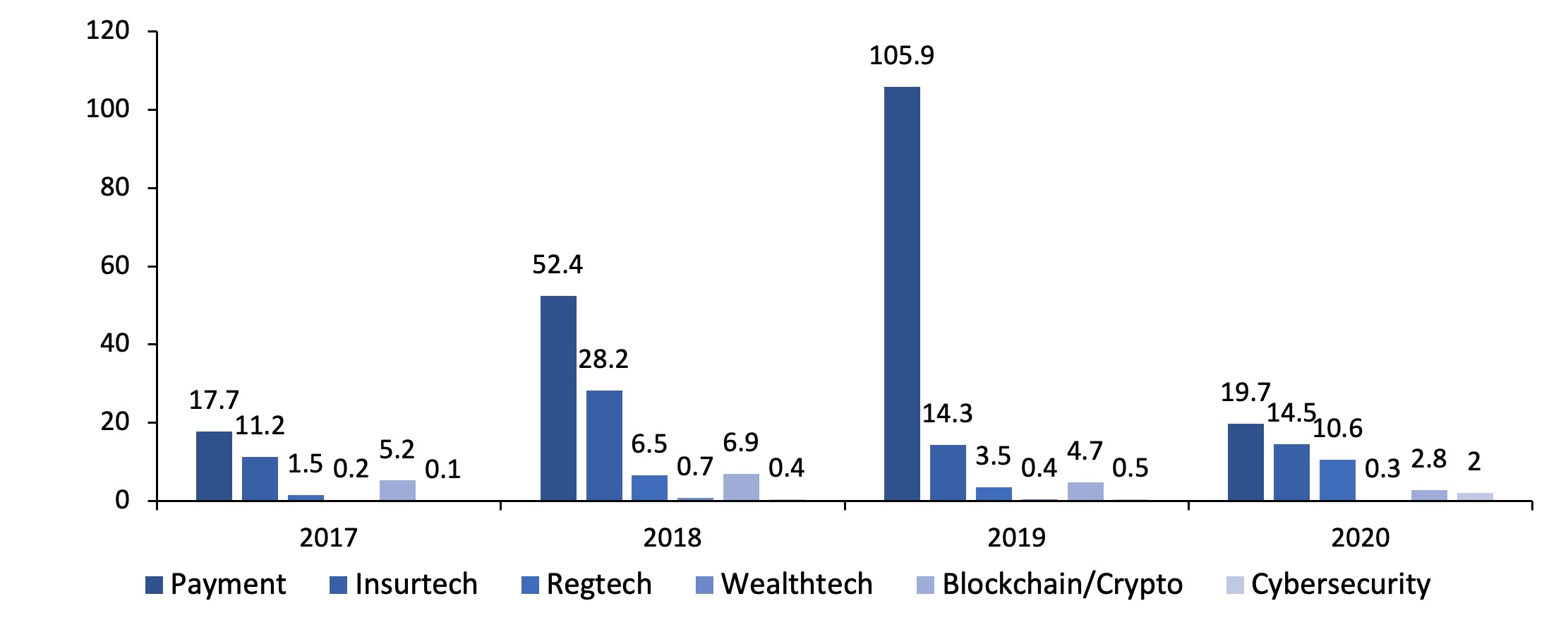

Investment by FinTech Sub-Sector from 2017 to 2020

Source: KPMG International

Payments will continue to dominate FinTech

Driven by the global pandemic and the need for alternative payment solutions, financial institutions are still improving their payment infrastructures, either through partnerships, investments, or M&A. With new regulations surrounding the payment sphere (i.e., Open-Banking), we expect to see more activity from investors willing to bring solutions to financial institutions in need of more embedded B2B payment solutions.

Written by Guillaume Chabot, RCG